Home❯Investor❯ Latest Quarterly Financials

Quarterly Report For The Financial Period Ended 31 December 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

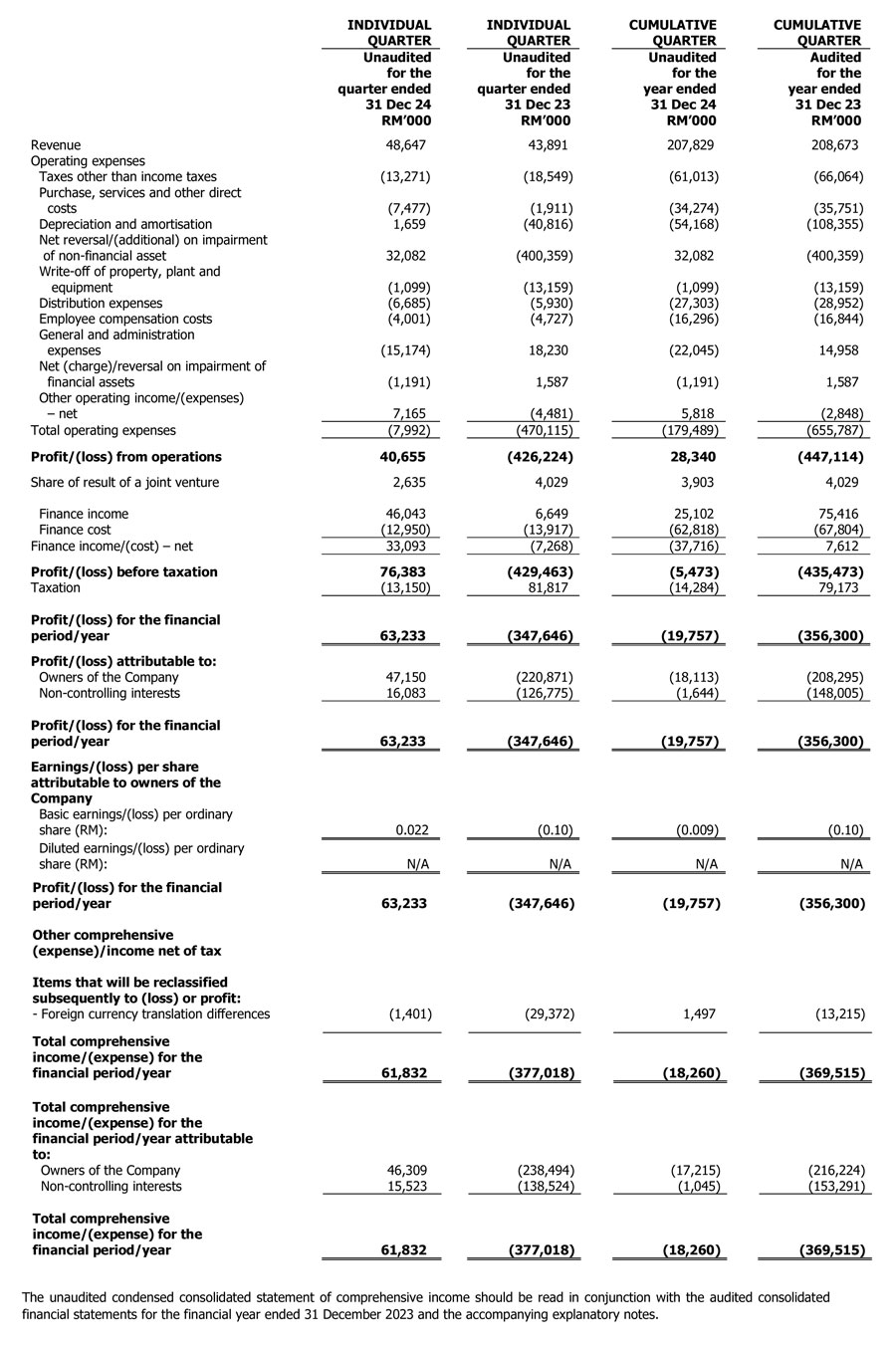

Unaudited Condensed Consolidated Statement Of Comprehensive Income

For The Financial Period 1 October 2024 to 31 December 2024

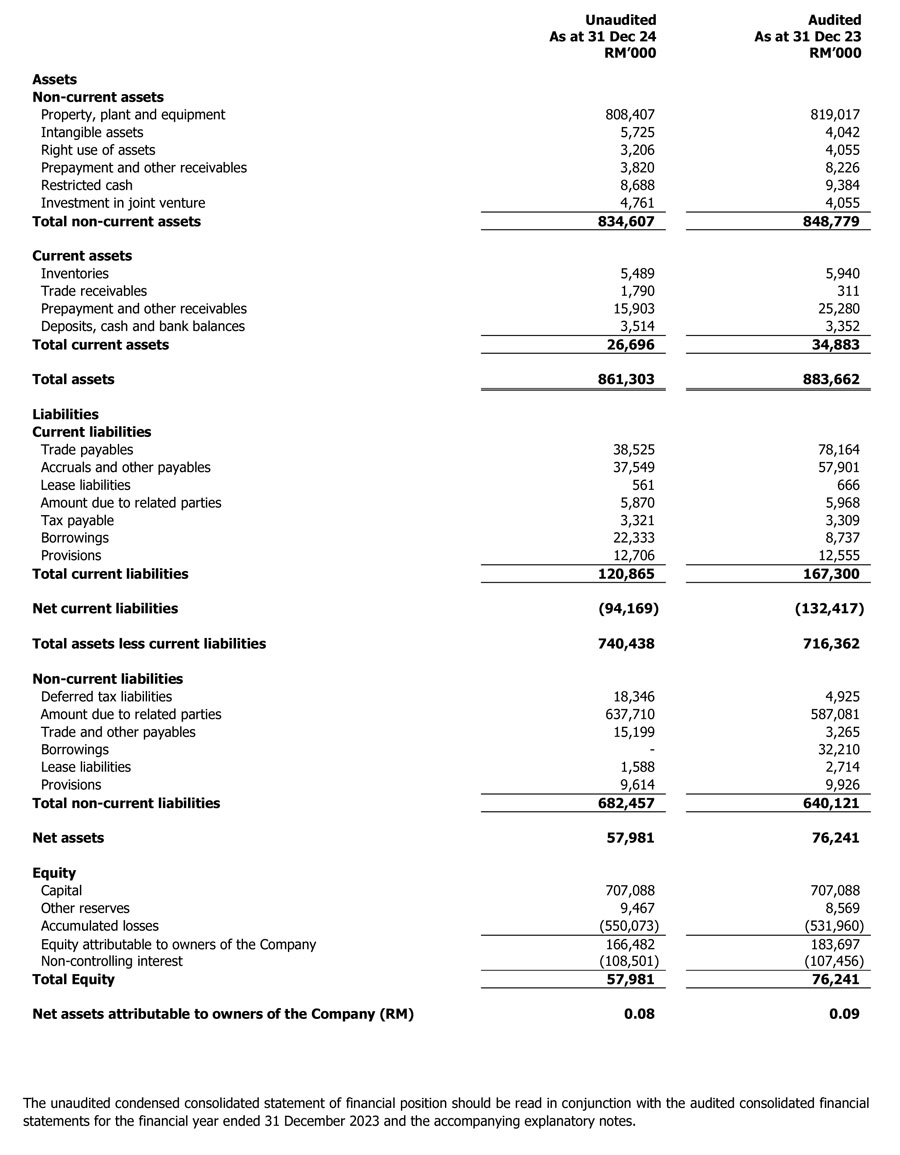

Unaudited Condensed Consolidated Statement Of Financial Position As At 31 December 2024

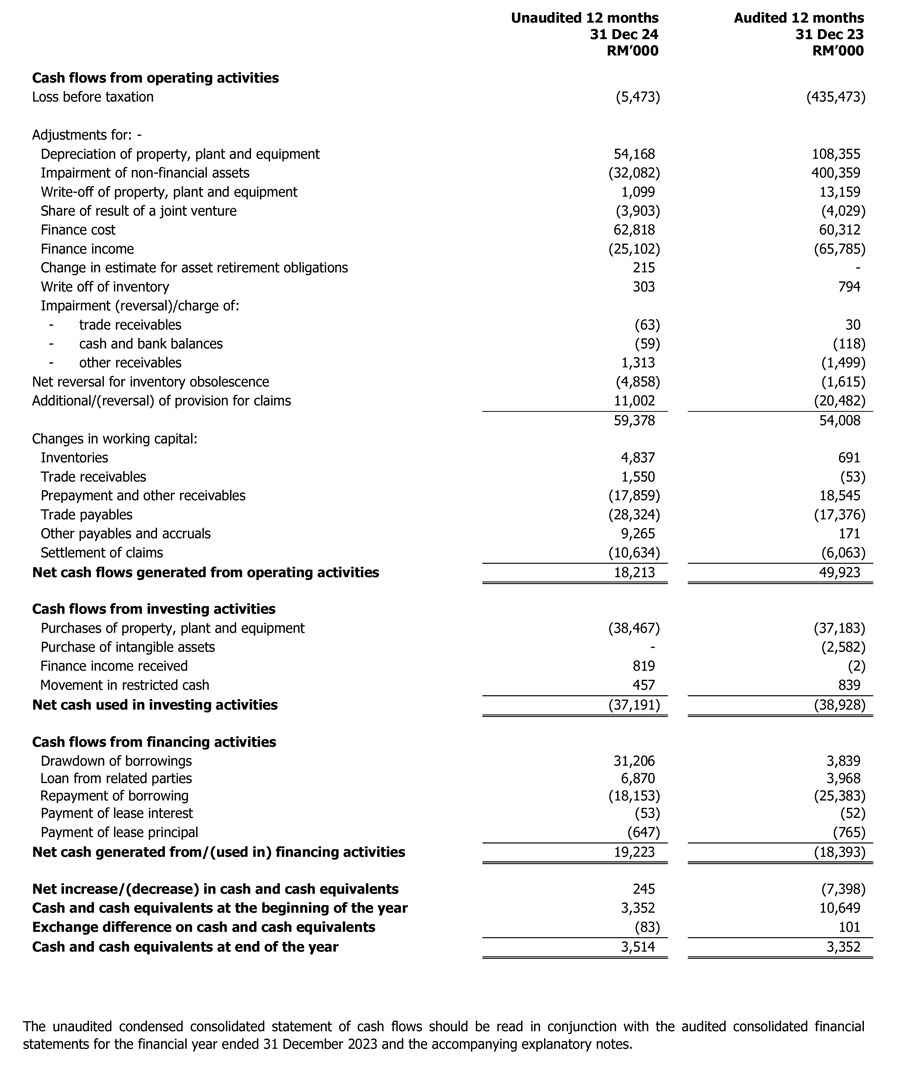

Unaudited Condensed Consolidated Statement Of Cash Flows For The Financial Period Ended 31 December 2024

Prospect

Moving forward, we continue to expect the path towards sustained demand recovery to remain fragile and uncertain as the oil market adjusts to both short-term and long-term landscapes. The industry is continuously facing headwinds from the geopolitical conflict between Russia and Ukraine which resulted in a price inflation and goods distribution disruption.

Our plan in 2024 was to drill and complete one development well in our North Kariman field (NK103) and the work is still ongoing there to bring to production. With the addition of possibly one more new development well, we estimate that the North Kariman field will contribute higher production output over the field life.

It's common for a well's production to decrease after its initial peak, as a means of increasing production output from oil wells we have previously implemented secondary production methods, specifically a gas injection pilot in the second half of 2023. In addition, we are assessing the feasibility of implementing other methods and started a water-injection pilot in Kariman at the end of the fourth quarter of 2024 as a method to enhance production, however these pilots can take a significant period (e.g. more than six months) before discernible results are found.

For delivering of our production target, we will continue to place emphasis on efforts to sustain and further enhance current production level through well workover programs which will involve the replacement of electrical submersible pumps ("ESPs") for the artificial lifting of oil to the surface, re-perforation and stimulation of certain naturally flowing wells and continue with the planned reactivation of idle wells. At the same time, we will also continue to perform maintenance works to improve facilities uptime and facilities debottlenecking; a successful planned maintenance shut-down of the facilities was undertaken in the end of the third quarter/early fourth quarter of 2024 which achieved its objectives and within Health, Safety, and Environment ("HSE") guidelines. The drilling program will be completed in stages in accordance with the Group’s financial capability. Drilling on other fields such as Dollinnoe is planned in the future.

We anticipate that the wells in the Proved Developed Producing category will remain operational through 2025 and beyond, with occasional ESP replacements as needed. However, we do expect the production rates of these wells to decline gradually since for example, the Kariman field has low reservoir pressure, which is typical of a mature field and at some future point the ESPs might need to be retrieved due to economic viability.

Aside from implementing initiatives to improve our production output and increase production efficiency, we also intend to address and resolve the price differential issue that has been plaguing Emir-Oil recently and had adversely affected our export sales margins. We are in the midst of identifying alternative routes and negotiating the terms with several potential buyers to enable us to sell our crude oil closer to the international Brent oil prices.

In summary, Emir-Oil needs to drill more development wells, perform well workovers and production enhancement initiatives such as secondary recovery to increase the production and implement cost optimisation efforts.